Currently it is $31.4tn (£25tn).

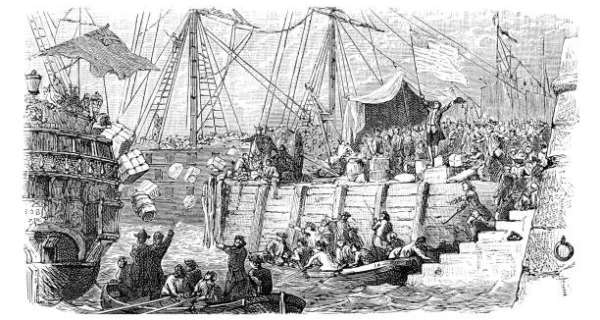

Every year ever since the Obama Administration took office I noticed something i’ve never noticed before. Perhaps I got distracted during the Clinton Administration with the President at that time dealing it the Monica Lewinsky scandal, Arafat in Palestine and last but not least smoking yet not inhaling so as to avoid impeachment and uphold some form of Presidential professionalism. I can also see how i may have also been distracted during the the Bush administration while on active duty with the war on terrorism, the creation of the department of homeland security, the war on terrorism and the wiretapping of American citizens without approval from the appropriate legal governing authority.. in a nutshell i never noticed that ever so often, US Congress must vote to raise or suspend what is known as the ceiling, so our nation can borrow more money to pay our bills. Currently it is $31.4tn (£25tn).

Reduction In Transaction Costs

Governed By Capitalism

For this scenario to gain a better understanding of the severity of the above mention circumstances in combination with global events, i would like us as Americans since we are governed by capitalism we will be a large corporation. Now that we are in business, lets take a look at our expenses.

1) All federal employees excluding the military

2) The Military

3) Our interest rate on our total debt

4) Social Security

5) Medicare

6) Tax Refunds

Joe Biden for this scenario would the current C.E.O with congress being our board members. The board member situation is a little tricky where some support Joe Biden on some policies while others don’t and this only gets revealed during a vote and the CEO get the privilege of being made fun of by a variety of media outlets when members of their own party does not support them. In the deal that passed through Congress, they have not raised the limit to a certain level, but suspended it entirely until 2025. This raises the question as to why would they make such a move in the midst of approximately twenty four countries are in collusion with China to refrain from using the US Dollar as the common currency for trade and introduced BRICCS instead. BRICS is an acronym for Brazil, Russia, India, China, and South Africa. This new currency is designed to the lower transaction costs related to international trade, eliminating the barrier of entry costs for developing countries to engage in global trade and increase competitiveness in global markets.

It's All About Consumer Spending

What If We Dont Borrow

If the C.E.O. If we didn't borrow it would be catastrophic for our nation. The above mentioned services would not be fulfilled but let's take a closer look at welfare. If the government is unable to pay for the welfare of their citizens the economy will slow down. Since the citizens now wont have the ability to pay their bills or have the cash flow to spend.. This will lower consumption on a global scale. would have big knock-on effects for the rest of the world, many of which count the US as a key trading partner. Mortgage's and employment will be affected internationally due to the fact that investors charges interest to the government on our treasury bonds.. If the US government does not repay its debt or even pay the interest, investors could then demand a higher interest rate to buy government debt. This would then make all debt expenses overnight be it a Mortgage or any other public debt

Conclusion

Another factor we should take into consideration is the 2024 Presidential election. By putting a cap on spending with the exception of our military budget, will allows us to pay our bills up until the next fight over raising the ceiling without interfering with the presidential election.

0 Comments